How do you choose – pension or lump sum?

Pension payment options are guaranteed for your life, and you don’t have to worry about outliving the money.

Lump sum option requires you to take the money, roll it over into an IRA, invest it, and generate cash flows by taking systematic withdraws throughout your life.

As a retiree eligible for a pension this is a question that could cost/benefit you thousands or tens of thousands of dollars.

Highly consequently financial decisions demand your calculated attention.

The risk to consider here is what kind of return must be generated on the lump sum to replicate the payments of the pension option.

The higher the rate of return required of the lump sum to replace the pension payments, the greater the risk and less likelihood you will pursue the lump sum option.

On the other hand, if your lump sum amount only requires a 1% to 2% rate of return to re-create the same pension cash flows over your calculated lifetime, the lower the risk and greater likelihood you will pursue the lump sum option.

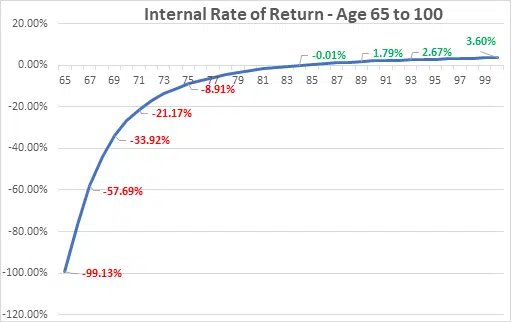

This trade-off boils down to calculating the internal rate of return of the pension cash flows, which reveals the required rate of return that a lump sum portfolio would have to earn to re-create the same payments as the pension over the specified time horizon.

The rate of return that must be earned on a lump sum to replace the payments of a pension will largely rest on the life expectancy of the individual.

If you take the pension option and only live for 4 years, you give up any option for a beneficiary to receive an inheritance (survivorship option not permitting).

How to Choose

Working out an example, if an individual has the option to take either a $23,435 pension or a $449,693 lump sum. How do you choose?

Simple math tells us that it would take just over 19 years to recoup the original lump sum.

If we assume that this individual lives until age 100, what rate of return is required to generate the same payouts as the pension payout?

In this example, this individual’s portfolio would need to generate a 3.60% return to get the same $23,435 pension payment for a 35-year period.

Given the historical stock and bond market performance, I’d be confident that you could estimate future expected returns to meet or exceed this required rate of return.

This is a favorable scenario for the lump sum option. Not all scenarios play out like this. Various factors play into the decision:

- Pass sooner:

- Pass later:

- Larger lump sum:

- Small lump sum:

![]() Rate of return

Rate of return![]() Rate of return

Rate of return![]() Rate of return

Rate of return![]() Rate of return

Rate of return

This decision is ultimately a trade-off.

In today’s environment, many private pension plans are underfunded.

While the Pension benefit Guaranty Corporation (PBGC) backs many corporate pension plans they insure only a portion of the balance so if your company does default the PBGC payout may be smaller than what your company originally promised.

While this is unlikely, it has happened in the past and is not a risk that should be overlooked.

Ultimately, the decision on whether to take the pension or lump sum is driven by your ability to use the lump sum to re-create cash flows similar to the pension plan. Each pension plan is different and will require a one-by-one analysis to determine which option is best.

Which option is right for you?

You may be surprised it wasn’t the answer you expected.