There are many things you can avoid in life such as cavities if you brush and floss your teeth. On the other hand, paying taxes is an unavoidable responsibility, yet you can reduce the amount owed by keeping yourself informed of recent tax laws and utilizing the provisions in the tax code.

The US House of Representatives passed the Consolidated Appropriations Act of 2023, also known as the SECURE Act 2.0, on December 23rd, 2022. This 1,653-page bill includes changes in tax planning, specifically related to retirement and financial planning. Here are some of the most important changes you should be aware of.

1. Required Minimum Distribution (RMD) Age

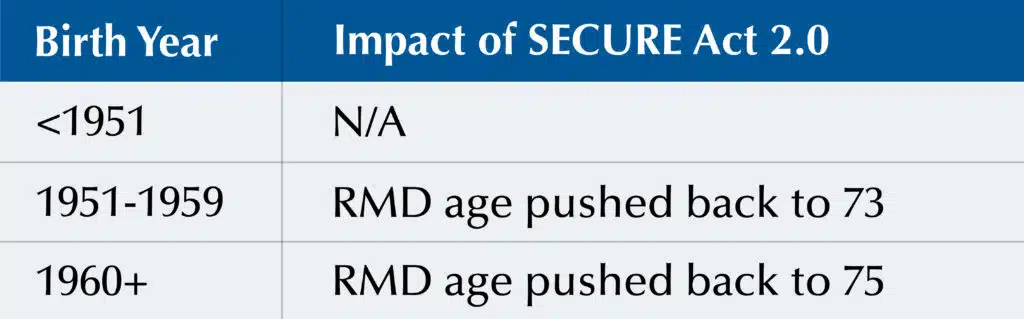

One of the most notable changes in the SECURE Act 2.0 is the pushback of the Required Minimum Distribution (RMD) age from 72 to 75. The change is based on the birth year and those turning 72 in 2023 will no longer be required to take their RMD. This means fewer years of forced distribution from retirement accounts, potentially lowering the total tax due.

However, it also means you have less time to get the money out of your retirement accounts, further emphasizing the importance of Roth conversions in the years leading up to the RMD age to minimize lifetime tax liability.

The SECURE Act of 2019 removed the stretch IRA provision, which allowed beneficiaries to take RMDs based on their lifespan, and now non-eligible designated beneficiaries will have 10 years to pull that money out of their retirement accounts, potentially increasing their tax liability.

2. Qualified Charitable Distributions (QCDs)

It’s worth noting that Qualified Charitable Distributions (QCDs) are an exception to the RMD rules and are set in the tax code at age 70.5. The SECURE Act 2.0 also increased the total amount allowed for QCDs from $100,000 to $200,000 with a cost-of-living adjustment to be added in 2024.

3. Higher Catch-Up Contributions

Starting in 2024, the catch-up contribution limit for IRAs will be adjusted annually for inflation in increments of $100.

In addition, the catch-up contribution limit for individuals ages 60-63 in retirement plans will increase to the greater of $10,000 or 150% of the regular catch-up amount for the year 2024.

It’s important to be aware that this change in catch-up contributions is separate from the $145,000 Roth mandatory contribution election. This refers specifically to the maximum number of catch-up contributions allowed.

4. Roth Provisions

The SECURE Act 2.0 brought significant updates to the Roth provisions in the tax code, making it a popular choice for both taxpayers and Congress.

Starting in 2024, Roth contributions to employer-sponsored plans (401(k), 403(b), and TSP) will be exempt from RMDs. This means that if you have an employer-sponsored plan and have been taking RMDs, you will be able to stop in 2024.

Additionally, in 2023, the SECURE Act 2.0 introduced the availability of Roth SEP and SIMPLE IRAs, which were previously only available as pre-tax contributions. This change makes it a viable option for those considering switching to a 401(k).

Once you make the Roth contribution election, you cannot recharacterize it as a Traditional contribution in an employer plan. However, you can recharacterize Roth contributions to Traditional in an IRA.

Employer contributions can also be made to only matching and non-elective contributions, with the exception of profit sharing. This means that the amounts of employer-matching contributions will be included in the employee’s gross income for the year and will not be subject to a vesting schedule.

Overall, the SECURE Act 2.0 updates to the Roth provisions provide taxpayers with more flexible and tax-friendly options for their retirement savings.

5. 529-to-Roth IRA Transfers

As of 2024, transferring funds from a 529 college savings plan to the Roth IRA of the plan’s beneficiary will be possible.

This transfer must take place directly from the 529 plan to the Roth IRA and the Roth IRA must be established for the exclusive benefit of the 529 plan’s beneficiary.

There is a lifetime transfer limit of $35,000 per beneficiary, which is subject to the annual contribution limits of IRAs, excluding any regular Traditional or Roth contributions. This limit is not impacted by the Roth IRA’s income limits.

In order to make the transfer, the 529 plan must have existed for at least 15 years. However, you can start the 15-year clock by contributing just $1 to the 529 plan, so that its growth can be tax-deferred and passed on to the designated beneficiary, who can also be changed later.

Please note that the conversion must satisfy two conditions:

- The assets must be in the account longer than 5 years and the 15-year clock must be satisfied.

- Contributions and earnings from the last 5 years cannot be transferred.

6. Retirement Access Plan

Another key change is the expansion of the age 50 exception for public safety workers to include private-sector firefighters, state, and local correction officers, and plan participants who have separated from service after 25 or more years of service.

Qualified Disaster Recovery Distributions without penalties can be taken up to a maximum amount of $22,000 and must be repaid within a period of 3 years. These distributions are only available if the disaster is recognized as a Federally Declared Disaster Area and if your primary residence is located within the designated disaster area. The distributions must be made within the 180 days of the declared disaster.

The definition of terminal illness has also been expanded from two years to seven years. This means that if a doctor has certified that an individual will pass away within seven years, they can access their retirement plans penalty-free.

Victims of domestic abuse can access a maximum distribution of either $10,000 or 50% of their vested balance. These distributions are repayable for up to three years.

Starting in 2024, individuals will be able to take a penalty-free $1,000 distribution in case of an emergency expense. This distribution must also be repaid within three years. For those in need of long-term care, starting in 2026, they can access the lesser of $2,500 or 10% of their vested account balance.

The SECURE Act 2.0 has also eliminated the penalty on the distribution of earnings on excess contributions. However, the excess contribution remains taxable. Employer-sponsored plans can now be corrected with ease, as the penalties have become more relaxed.

In 2024, individuals who are making 72(t) distributions from an account will be able to roll over a portion to another account as long as the total payments for satisfying the 72(t) distribution are satisfied. Emergency savings accounts (ESAs) must also be attached to an employer-plan account beginning in 2024, with a maximum account balance of $2,500.

For sole proprietors, they can now make retroactive salary deferrals for prior years, making it easier to contribute to their 401(k) plans. The SIMPLE IRA has also become more complex, with different contribution limits depending on the number of employees at a company. Employers can now match payments made by plan participants to their student loans, making it easier for individuals to reduce their student loan burden.

Starting in 2027, the Saver’s credit will be deposited into a saver’s retirement account, matching 50% of the first $2,000 of taxpayer contributions to a retirement plan. Employers who start a small business with up to 50 employees will also receive increased credits, with a start-up credit for employer matching contributions.

Mandatory auto-enrollment will be required for employer plans starting in 2025, with an initial default rate of at least 3% and a maximum of 20% increasing by 1% annually until at least 10% (but not greater than 15%). Exemptions include plans that existed prior to 2025, governmental/church plans, employers with less than 10 employees, and SIMPLE IRA plans.

In 2024, a starter 401(k) plan will be offered, allowing for only employee contributions. This plan will be limited to the IRA contributions limits, rather than the $22,500 limit.

Key takeaways:

- RMD Age: The age for required minimum distributions has been pushed back from 72 to 75, based on the birth year. This means fewer years of forced distributions from retirement accounts, but also less time to get the money out of them.

- Qualified Charitable Distributions: QCDs are an exception to the RMD rules and are set at age 70.5, with the limit increased from $100,000 to $200,000 with a cost-of-living adjustment to be added in 2024.

- Higher Catch-Up Contributions: The catch-up contribution limit for IRAs will be adjusted annually for inflation starting in 2024, and the limit for individuals ages 60-63 in retirement plans will increase in 2024.

- Roth Provisions: The SECURE Act 2.0 brought significant updates to the Roth provisions, including Roth contributions to employer-sponsored plans being exempt from RMDs starting in 2024, and the availability of Roth SEP and SIMPLE IRAs in 2023. There is a lifetime transfer limit of $35,000 per beneficiary for transferring funds from a 529 college savings plan to a Roth IRA, starting in 2024.

- Retirement Plan Access: The age 50 exception for public safety workers has been expanded to include private-sector firefighters, correction officers, and plan participants who have separated from service after 25 years. Disaster recovery distributions can be taken without penalties up to $22,000 and must be repaid within 3 years.

- Other Changes: The bill includes other changes such as additional tax credits for employers who adopt new retirement plans, the ability to contribute to IRAs for longer periods of time, and the removal of contribution limits for long-term, part-time employees.