As the economy has shifted and we all take a step back to reevaluate what is most important, the question we’ve been getting a lot recently, is “Where do I Start?” At Blue Rock Financial Group we work with three main groups of clients:

- Business Owners

- Pre-Retirees & Retirees

- Executives

For each of these groups, the considerations are similar but slightly different.

Business Owners

For most, the last few years have been quite good. With the influx of stimulus into the financial system, we’ve seen many people willing to spend a little more, watch their budget a little less and focus on anything that makes them happy. Businesses have benefitted from looser checkbooks and free-flowing cash. As we move from 2022 and deeper into 2023, the tide is starting to turn. At the end of the first quarter of 2023, we saw savings accounts at an all-time high, over $5T. That’s the first time we’ve ever eclipsed that number and it shows two things. First, there is still a bunch of extra money in the system. Second, there is a shift, where people are prioritizing saving over spending.

The rise in interest rates over the last 12 months is something we haven’t seen in over 40 years. The Federal Reserve has prioritized inflation as their main concern and their biggest tool to combat inflation is to raise interest rates. This mechanism is designed to curb spending and incentivize saving.

For business owners, there must be considerations that the wave of spending may start to slow. Therefore, the profits that most businesses have seen in the last two years, are likely to slow, some may see slowdowns as high as 30%, or in real estate, even more. What will this mean for business owners as they navigate their business in 2023? From the Federal Reserve’s point of view, there is still one economic measure that has proved pesky to tame and that’s unemployment, but not how you may think. The longer unemployment stays low, the longer inflation will hang around. That means that we will potentially see a longer period of slowing or little growth or contraction in the economy. What? Yes, read that again. If unemployment starts to tick up, it’s likely that we will enter the next phase of the economic cycle sooner. The consensus is that the US economy is currently in the late stage of growth. Typically, after this phase, we see a contraction in the economy and potentially a recession. Then the cycle ramps up again and we go into a recovery phase where growth returns.

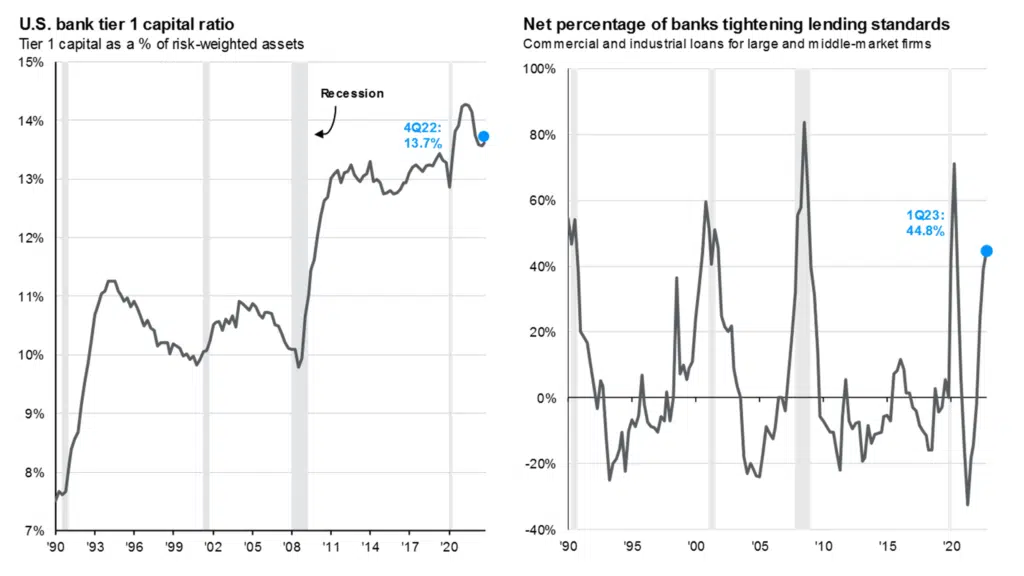

What are other factors that businesses will likely deal with moving forward? Well, higher borrowing rates, this has already begun. Where this hurts the most, is on the big purchases for business owners, such as real estate, large equipment purchases, etc. What’s next? Well, banks are now being forced to pay higher rates on their savings, which is, in many cases pushing up the reserve requirement for them. So banks are charging more and because their reserve requirements are getting pushed up, they are going to be lending less (many have already slowed this down in certain sectors). That is where the words “credit crunch” are coming from, which you may have been hearing.

Businesses are likely going to be dealing with slowing revenues and new challenges pertaining to growth. Carrying a higher reserve may be necessary along with amending revenue projections for the next couple of years.

Individuals

First, let’s look at considerations for Pre Retirees and Retirees. Inflation has provided a welcomed raise to Social Security benefits over the last two years of 5.9% and 8.7% respectively for 2021 and 2022. Considering the average increase over the prior 10 years was a measly 1.65%. However, when Social Security benefits rise, so does the cost of living. As retiree portfolios have fluctuated substantially the question becomes whether or not their living expenses have grown, remained steady, or if they have fallen. In each scenario, we can’t change the past, we can only focus on the future. The lives of retirees can be somewhat isolated from what’s happening in the Labor market, businesses, etc. This can be a pro or a con. Self-awareness of one’s situation is extremely important when there is volatility in the economic cycle. Course correction or adjustments are required in many cases for retirees to still be able to meet their short and long-term goals. And yes, even as retirees, desires, and goals change as the years go on. Get dialed in and be sure to understand where you are headed.

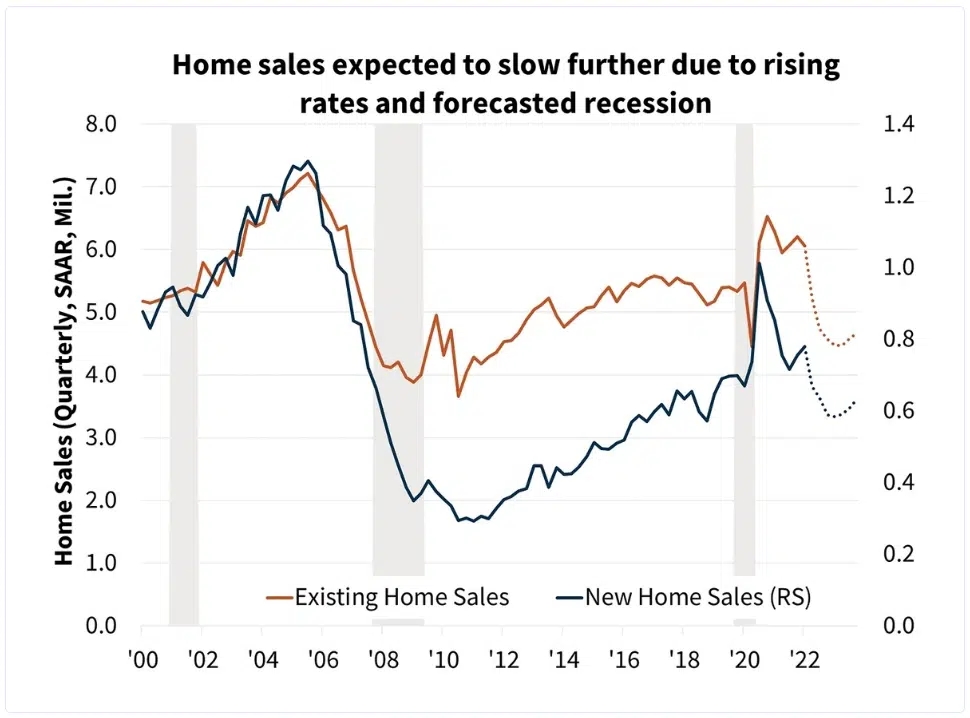

For Executives or those who are still working and earning an income, this cycle may present unwanted opportunities. What do I mean by that? Well, there are big challenges when it comes to buying a home right now. If a family is looking to upsize their home or potentially even buy their first, they have unique challenges. Prices are high, rates are high and inventory is low (but growing). They may be antsy to make a change, however, if they’re currently in a home, their monthly payment is likely manageable, and their interest rate is likely in the 3’s or potentially below. Having the fortitude to sit tight and be patient will likely pay off in a big way. Continue to save aggressively instead of taking on an unreasonably high mortgage payment. Sure you can refinance when rates come down, but when will they come down, and by how much? No one knows but likely not soon.

One thing we try to do for all clients who are in the accumulation phase is to add a line item for monthly savings. Whether that’s into a company-sponsored retirement plan, into an investment account outside of a company plan, or into cash (and maybe all three). Why do we do this? Because this savings line item is not only increasing their net worth, it’s also pushing their monthly spending down. They are earning the money to spend; however, they’re choosing to save. This is one of the best (and easiest) ways to prepare for life beyond earned income.

Saving has become less enticing compared to the past five years. Previously, investors experienced immediate gratification as their accounts surged with the stock market’s rapid growth, providing a dopamine rush. However, current investments may not generate the same immediate returns, necessitating a longer-term perspective. Why? Simply because of where we are in the economic cycle. There is more uncertainty and instability in returns. When you make an investment today, you may be purchasing more shares of that investment than you were able to purchase a year or two ago. Companies are “on-sale”. So determining where to save, should be determined by the timeline of when you want to spend the dollars you are saving. The longer the window of time an investment has to work for you, usually, the more aggressive your allocation should be.

In these dynamic times, it’s crucial to stay informed and adapt to the changing economic landscape. Whether you’re a business owner, a pre-retiree, a retiree, or an executive, taking proactive steps can help navigate the challenges and seize the opportunities that arise. You can reach out to us with any questions you have by clicking here. We’d love to hear from you!