We’re one of the most comprehensive Financial Planners in Sussex County, as seen in:

Why Choose Blue Rock Financial Group?

We’ve built financial planning for all that you are.

For Your Entire Life (Not Just Your Investments)

Every financial decision has an impact. We advise on your Current Financial Position, Investment Planning, Tax Planning, Insurance Planning, Estate Planning and more. When you make a decision in one area, it has an impact on all the others. Understanding that impact before you act will give you confidence the decisions you are making are the right ones.The Highest Level of Financial Planning

Personalized financial advice goes beyond standard plans to meet your individual needs. How would it feel to have a partner to guide you once you are retired (unemployed)? For many, retirement equals freedom, and for some uncertainty. Our approach is comprehensive, to ensure your decisions don’t create unintended surprises in the future.Fair Fees With No Surprises

Value has been lost in our society. Price is about getting more value than you pay. At Blue Rock, we are faithfully committed to providing far more value and peace of mind than we charge.How We Can Help

Your goals are personal. Your financial plan should be too. We lay the building blocks for a more confident financial future - covering essentials, ensuring lifestyle, preparing for the unexpected, and/or leaving a legacy.

Life Milestones

- Retirement Planning

- Assisting Kids and Grandkids

- Healthcare or medical expenses

- Inheritance or death in the family

- Elder care planning

Advisor Coordination

- Working with your Accountant & Estate Attorney

- Ensuring a cohesive plan among all

- Asset Coordination – ensure documents match your goals

- Trust Planning

Investments & Taxes

- Investment management and optimization

- Unique retirement income strategies

- Market and tax law changes

- Proactive tax planning

- Asset location planning

Retirement & Estate Planning

- Distribution strategies

- Charitable giving

- Gifting

- Navigating Social Security

- Healthcare planning

How We Work With You

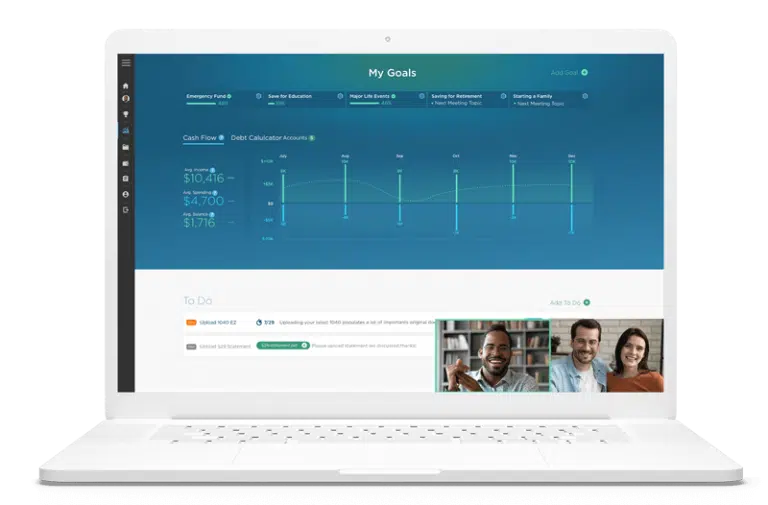

Take a look at what it’s like to work with Blue Rock Financial Group.

Meet your CFP® Professional

You will have access to a team of CERTIFIED FINANCIAL PLANNER™ professionals--the highest possible certification--and go into detail about your full financial life story to focus on what matters most to you.

Build a Plan & Put it Into Action

You’ll work with your CFP® professional to establish a strong foundation, reveal choices you didn’t know you had, and ensure you’re making the right decisions. We will work with you to execute your plan.

Nurture Your Plan

Since your financial plan needs to keep evolving based on what changes in the world and in your life, we meet with you at least annually to completely rework your Financial Plan. Along with 2 additional check-ins, your CFP® professional is available to you when questions arise.

Learn more about how we build a personalized, high-impact plan to create your best financial outcomes.

We’re one of the most comprehensive financial services companies in Sussex County.

40

-

0

%

Average Net Worth

Increase Over 5 Years

49

%

Client

Retention

50

%

Advisors hold

Professional Designations

Grow Your Knowledge

We think financial planning information should answer more of the questions we all have and be less complicated. Learn about how we approach personal finance through our library of free articles that will help you deepen your financial literacy.

Explore More

See for yourself why we’re one of the most comprehensive financial services companies in Sussex County, Delaware.

Get Started

To schedule a free consultation with a Blue Rock expert, fill out the form below and we will contact you within 24 hours.

OR

To speak with someone now, call us at

(302) PLANNER

By submitting this form, you acknowledge that you have directly provided the email and phone number contact information listed, further acknowledge that Blue Rock Financial Group has the option to use either method to contact you, and agree to the terms set forth in our Company Privacy Notice. If you need assistance, please email [email protected].