You’ve saved for the last 40 years and are thinking about retirement. Now what?

Retirement is a monumental pivot in your financial journey. Prior to retirement, your goals were to accumulate as much wealth, in the right accounts as possible. Your discipline and consistency have paid off.

Your job now?

Create your own paycheck to last your entire life.

The skills that allowed you to save, are not the same skills that will not allow you to retire.

Prior to retirement, poor spending habits can be absorbed with a steady paycheck. Post-retirement, poor spending habits drain your portfolio. With unknown market conditions approaching retirement with a margin of safety is wise to allow for error to occur and success as the outcome.

Charlie Munger has a famous quote, “All I want to know is where I’m going to die, so I’ll never go there.” The key to solving difficult problems is to address them backward. By knowing what to avoid, you can uncover unique insights into the problem you’re looking to solve.

Method #1: Withdrawing from the wrong accounts at the wrong time

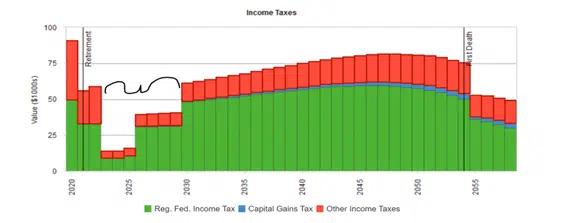

If you have properly prepared for retirement, you will have several buckets of money all taxed in different ways. The goal is to get you to pay as little tax as possible throughout your retirement. As a general rule, most retirees should spend down taxable money first, followed by tax-deferred, such as a traditional IRA or 401K, and lastly tax-free such as a Roth IRA.

Much like during your working years, you make more money each year as your spending is adjusted for inflation, you receive raises, and your skills increase. In retirement, Required Minimum Distributions (RMD) increase each year after age 72. If you’re pulling from your Roth IRA (which has no RMD) early, you’re missing out of the beauty of its future tax-free growth.

Method #2: Cashing Out Early

This goes without saying but if you pull your money out early, two things will occur:

- If you’re under age 59.5, you will incur a 10% penalty.

- You’re guaranteeing you’re to pay more taxes than necessary.

Flexibility in retirement is underrated.

Having both an emergency fund and a taxable brokerage account act as buffer if emergency spending is required. This avoids catastrophe (& increases peace of mind).

Method #3: Having Only Pre-Tax Money to Draw From

100% pre-tax dollars = 100% taxed as ordinary income

Pre-tax dollars are great because they allow you to receive a deduction for your contributions to a pre-tax account. If you contribute $10,000 to a 401k and you make $200,000, you’re only taxed on $190,000 of income.

If you continue to do this until retirement, say you’ve saved $2,000,000, you really only have ~$1,600,000 because you will pay ordinary income tax on every dollar taken out of this account.

How do you avoid this?

After you retire and before age 72 when Required Minimum Distributions (RMD) start there is a trough of income:

During this time, you can save money on taxes through a Roth conversion.

Paying today at a low rate today + taking it out at a higher rate later = tax savings!

Roth accounts grow tax-free in perpetuity.

Method #4: Claiming Social Security Too Early

You can begin to claim social security at age 62, but there are two caveats:

- You’ll receive a 30% reduction in benefits you receive

- If you’re still working, your benefit amount in 2022 is reduced $1 for every $2 earned above $19,560 until the year of Full Retirement Age (at which point your reduction is expanded to $1 for every $3 earned).

The biggest factors in determining when to take social security are your personal health and family longevity.

Unless your family history and personal health point towards premature passing (before age ~75). Waiting until Full Retirement Age is a good start. Making a small mistake here can needlessly cost you tens of thousands of dollars.

Method #5: Only Following the 4% Rule

Most people who are at all financially savvy have heard of the 4% Rule. This heuristic goes back 1994 research published by William Bengen where he investigated how much can be safely withdrawn from a portfolio each year.

After backtesting amidst historical market prices dating back to 1926, he concluded that 4.15% was safe to withdraw every year and after some rounding, the 4% Rule was born!

The 4% Rule is a good starting point, but it has been updated with further research since Bengen’s initial research was published.

By adding different asset classes, such as small-cap stocks, international stocks, and a decision-based spending framework, there’s flexibility to this rule.

Some additional rules to consider are as follows:

- The Withdrawal Rule: withdrawals are frozen relative to inflation in years following a negative return. This happened to many retirees in the crash of 2008 who saw their savings dwindle and had no choice but to spend down some of their assets to pay living expenses.

- The Portfolio Management Rule: gains are extracted from asset classes that perform well one year and are set aside in a cash account to fund future withdrawals. This turns a loss into a win.

- The Capital Preservation Rule: spending is cut by 10% if the withdrawal rate rises above 20% of the initial rate. You limit the amount of spending power lost in years of high inflation or a recession.

- The Prosperity Rule: this is the opposite of the Capital Preservation Rule and lets you enjoy the good years by increasing spending by 10% when the withdrawal rate falls by 20% below the initial rate. If your spending is reduced in a recession, it can increase in a market expansion.

Rules provide a good framework but don’t serve as absolutes. Ensuring flexibility relative to your situation is key for a successful retirement.

By considering new perspectives you’re exposed to new insights.

Avoid poor decisions is easier than seeking brilliance.