Bitcoin “mania” has made a resurgence so far this year, with the price of Bitcoin having risen by nearly 60 percent in the past month and reaching a new all-time high of roughly $69,000, breaking the previous record that was set in 2021. The Securities and Exchange Commission has even made the decision to begin approving Bitcoin exchange-traded funds (ETFs) that will open the door to further institutional adoption and legitimacy. From humble beginnings as a fringe technology to mainstream adoption and media frenzy, the rise of cryptocurrencies has captivated the imagination of investors and enthusiasts alike. In this article we will delve into a brief history of Bitcoin and discuss whether this relatively new investment phenomenon has any serious use case as a tangible long-term investment.

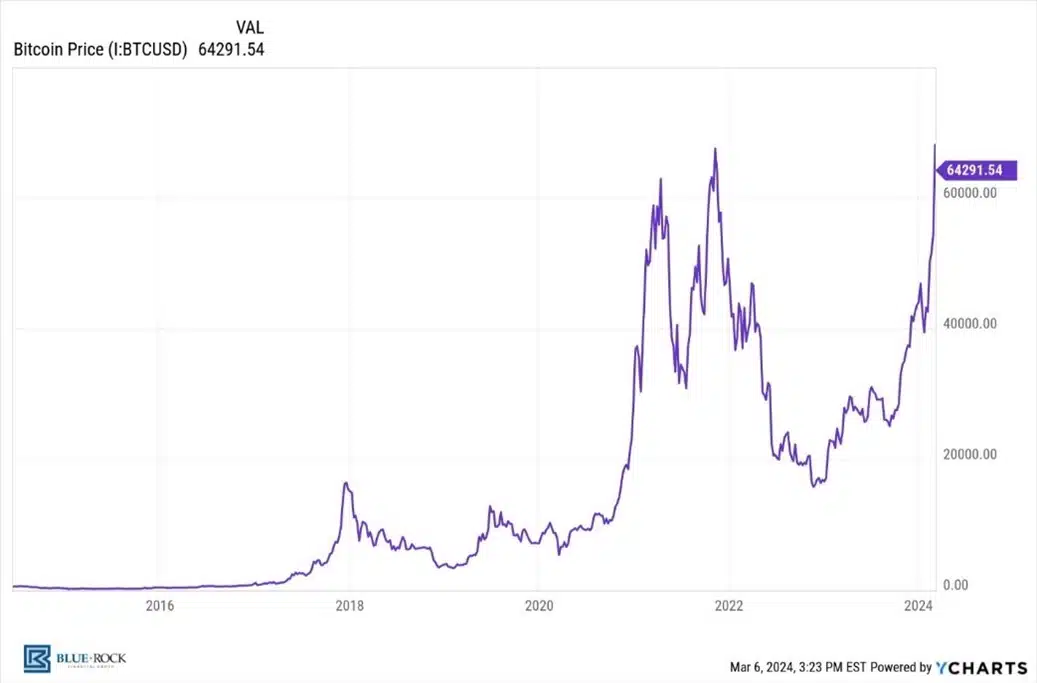

Bitcoin, the world’s first decentralized digital currency, was born in the aftermath of the 2008 financial crisis. Conceived by an enigmatic figure known as Satoshi Nakamoto, Bitcoin promised to revolutionize the way we think about money and finance. Built on the principles of decentralization and cryptography, Bitcoin offered a peer-to-peer payment system free from the control of governments and central banks. A community of early adopters and technology forward investors united around the nascent cryptocurrency, driving its development and adoption. In the years that followed, Bitcoin’s price soared from mere cents to thousands of dollars, attracting attention from curious investors seeking to capitalize on its meteoric rise (see Fig. 1).

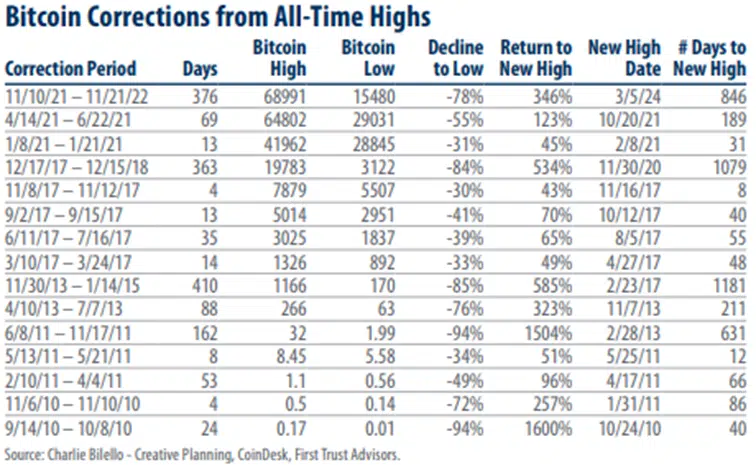

As Bitcoin gained prominence, a slew of alternative cryptocurrencies, or “altcoins,” emerged to challenge its dominance. From Ethereum to Ripple to Litecoin, these new digital assets sought to address perceived shortcomings in Bitcoin’s technology and functionality. Some touted faster transaction speeds, with others promised greater scalability or enhanced privacy features. This proliferation of altcoins only served to fuel the growing crypto mania, as investors rushed to snap up the latest tokens in hopes of striking it rich. Initial coin offerings (ICOs), a fundraising mechanism akin to IPOs in the traditional finance world, became the preferred method for launching new cryptocurrencies, with billions of dollars poured into these projects by eager investors. There are even! At the heart of the cryptocurrency mania lies a potent cocktail of speculation, FOMO (fear of missing out), and irrational exuberance. Unlike traditional assets such as stocks and bonds, cryptocurrencies lack intrinsic value and are currently driven primarily by sentiment and speculation. As a result, their prices are subject to wild swings and volatility, with large sums made and lost in the blink of an eye. Since 2010, Bitcoin has experienced 15 drawdowns of 30% or more from a previous peak. The most severe of these downturns include two drops of 94%, followed by declines of 85%, 84%, and 78% (See Fig. 2).

The media frenzy surrounding Bitcoin and crypto only serves to exacerbate the mania, with breathless headlines and social media hype driving retail investors into the market. Celebrities and influencers have eagerly promoted various cryptocurrencies (some altcoins actually follow your favorite social media meme!), adding fuel to the fire and further inflating prices. Investing in Bitcoin has not been for the faint of heart.

While crypto mania has undoubtedly created opportunities to make money, it has given rise to a host of challenges and risks. From rampant fraud (FTX and Alameda Research) to market manipulation and regulatory crackdowns (Binance), the crypto ecosystem is rife with pitfalls for unwary investors. Moreover, the environmental impact of cryptocurrencies, particularly Bitcoin, has come under scrutiny in recent years. The energy-intensive process of mining, which is essential to the operation of many cryptocurrencies, has raised concerns about carbon emissions and sustainability.

In the face of such uncertainty, investors must exercise caution and diligence when navigating the world of cryptocurrencies. The fact that there is no consensus agreement on what the ultimate best use case of crypto should be a major concern. Can it be considered a legitimate currency? With its wild price fluctuations, crypto currently does not lend itself to be a stable store of value (Remember the 10,000 Bitcoin for a large pizza?). Can it stave off inflation as a hedge? Possibly.

Bitcoin’s hard coded finite amount of 21 million coins lends itself to being inflation proof unlike a paper currency printed by a central bank. However, this has not necessarily worked in practice…yet. (El Salvador is really our first all-in case study). “On September 7, 2021, El Salvador became the first country to adopt Bitcoin as legal tender with the passage of that nation’s so-called “Bitcoin Law”, which placed Bitcoin alongside the U.S. dollar as El Salvador’s official currency. (An important distinction, however, is that while both the U.S. dollar and Bitcoin are legal tender in El Salvador, only Bitcoin is forced legal tender). This meant that all Salvadoran businesses must accept Bitcoin as a means of transaction, taxes are payable in Bitcoin, and the government can now distribute subsidies in Bitcoin. To accompany this law, El Salvador rolled out a supporting network of 200 Bitcoin ATMs, introduced a new digital bitcoin wallet app called Chivo, and distributed $30 worth of Bitcoin to every citizen to kickstart the change.” (Quirk, 2021) Is the idea of decentralization its best use case? Being decentralized – meaning no single entity can shut it off or control the ledger of transactions, as every computer on the network maintains a complete record of every transaction.

With the recent SEC decision to allow the creation of a Bitcoin ETFs and the looming Bitcoin “halving” (this is the rate at which new Bitcoin production gets cut by 50%), Bitcoin and its cohorts will undoubtedly be front and center in the media, the water cooler, and the dining room table. Prudent investors would be wise to approach Bitcoin and crypto with a healthy dose of skepticism and a long-term perspective. Crypto mania represents a paradigm shift in the world of finance, one characterized by excitement, speculation, and uncertainty. With any investment opportunity, investors must remember that the road to wealth is paved with diligence, patience, and sound judgment.