Summary of Quarter 3 Market:

- Driving most of the volatility during Quarter 3 was central banks across the world raising interest rates to fight inflation. The Federal Reserve raised interest rates 150 basis points during the third quarter with further hikes expected.

- Unlike the first half of the year, growth stocks, both domestically and internationally, held up slightly better during the 3rd quarter.

“Be Greedy when others are fearful.”

– Warren Buffett

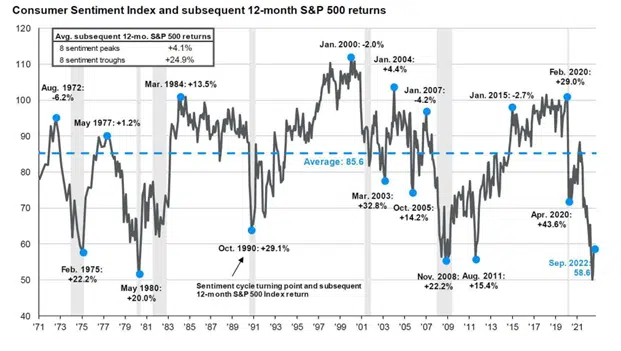

While 2022 has been tough for investors, and many think the outlook is bleak, historically periods of low consumer confidence have been some of the best times to be invested. Of the last 8 troughs in consumer sentiment, the return of the S&P 500 over the following 12 months averaged 24.9%. While it’s normal to be concerned when equity markets enter bear territory, market volatility is to be expected and it is important to stay invested and take advantage of the opportunities that periods of volatility provide.

Peak is defined as the highest index value before a series of lower lows, while a trough is defined as the lower index value before a series of higher highs Subsequent 12-month S&P 500 returns are price returns only, which excludes dividends. Past performance is not a reliable indicator of current and future results.

Guide to the Markets – U.S. Data are as of September 30, 2022.

Have you maxed out your 401k yet for 2022?

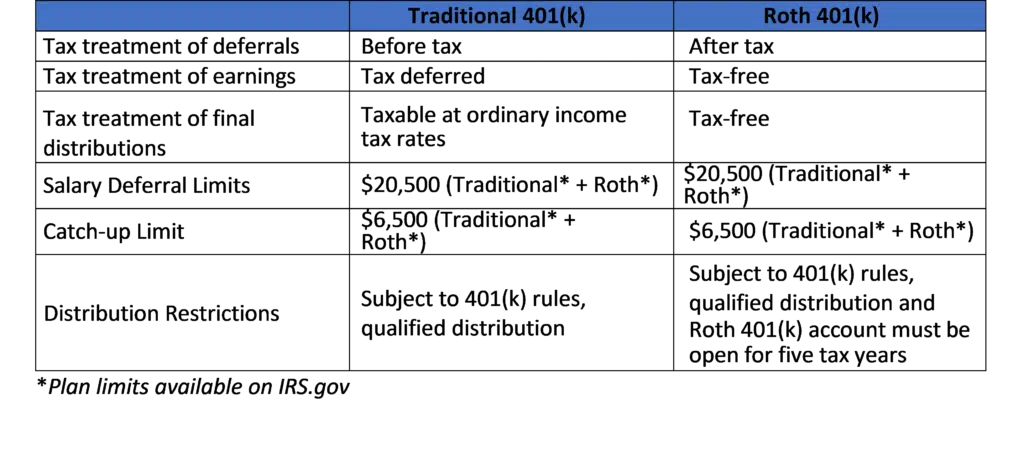

As we approach the final months of the year, we want to make sure Plan Sponsors and Trustees have maxed out their 401ks for 2022. The maximum employee contribution in 2022 is $20,500. Those 50+ can also make a catch-up contribution of $6,500, totaling $27,000.

Total 401(k) plan contributions by an employee and an employer (salary deferrals, employer match, profit sharing) cannot exceed $61,000 in 2022. If 50+ years old, catch-up contributions bump the 2022 maximum to $67,500. Total contributions cannot exceed 100% of an employee’s annual compensation.

Update for 2023: The annual contribution limit is increasing to $22,500. The catch-up contribution limit also increased to $7,500; therefore, those age 50 and over can contribute up to $30,000 starting in 2023.

You may be asking, what happens if I contributed TOO much to my 401(k)? If your 401(k) contributions exceed the limits, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. If you believe you have contributed too much, notify your payroll department immediately. You have until your tax filing deadline to fix the problem and get the money paid back to you.

*Plan limits available on IRS.gov

What is a Roth 401(k)? Is it right for me?

Elective deferral contributions to a traditional retirement plan are contributed on a pre-tax basis and help lower your current taxable income. If your plan allows them, Roth elective deferral contributions are much like a Roth IRA in that contributions are made on an after-tax basis. Money in the Roth account and any earnings will be distributed tax-free if withdrawn after age 59½, death, disability and at the end of the five-year taxable period during which the participant’s deferral is first deposited into the Roth 401(k) account (a.k.a. the Five Year Rule).

Who Would Likely Benefit?

- People who believe taxes will be greater in the future

- Young investors who believe they will be in a higher tax bracket in the future

- Investors who do not qualify for the Roth IRA due to income limit

- Low-income investors who are tax-exempt

- Investors who use Roth 401(k) as a planning tool in conjunction with traditional 401(k) plans

- Allows participants to hedge against risk of higher future tax rates

Who Would Likely Not Benefit?

- People certain that future tax rates will decrease

- People expecting to experience a significant drop in income upon retirement

- People with high temporary income

- People needing access to their funds within the first five years of deferrals